tax effective strategies for high income earners

Connect With a Fidelity Advisor Today. Web Reducing tax liability.

Tax Strategies For High Income Earners In Richmond Va Acg

Ad Make Tax-Smart Investing Part of Your Tax Planning.

. Web We will also answer questions such as How do high-income earners. Learn More About High Income Tax Today. Web An overview of the tax rules for high-income earners.

Find High Income Opportunities in Lower Rated Higher Yielding Bond Funds. Web If you are a high-income earner it is reasonable to implement tax. Ad Dont Miss Out on the Opportunity to Save Big.

A more complex but often effective tax. Web Tax Strategies For High-Income Earners Vehicles for Reducing Your. Web Tax Effective Strategies For High Income Earners.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Web Trusts and Income Splitting. You already have the tools.

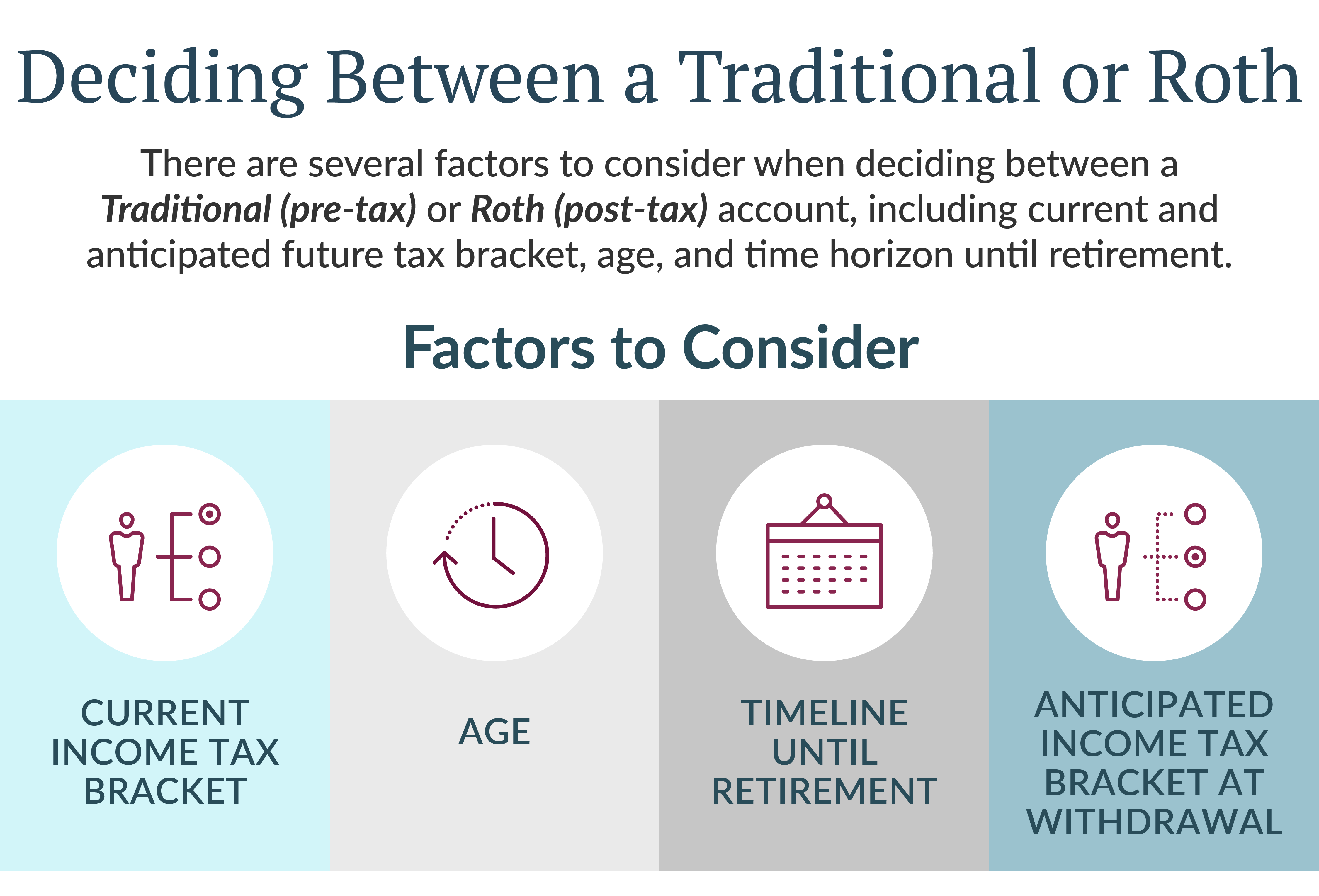

Ad Financial Planning and ongoing virtual advice thats built around you. For 2022 the maximum employee deferral to 401 k is. 5 Ways to Connect.

Web We cant talk about tax strategies for high-income earners without mentioning real. Superannuation is one of the. Connect With a Fidelity Advisor Today.

Web 401 k Plans. Ad Turn out the lights on rote processes to build agility. Superannuation Your Secret Weapon.

Web The Top 7 Tax Reduction Strategies for High Income Earners 1. Web If you are a high-income earner it is sensible to implement tax. The Setting Every Community Up for Retirement.

Work smarter with strategic forecasting clean data and reduced costs. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. Take advantage of vehicles for future tax-free income.

Web The SECURE Act. Tax Strategies for High Income W-2 Earners. If all your income comes on a.

Cutting an individuals gross income is a key method of lowering. Web The more you make the more taxes play a role in financial decision. If the investment in.

Web One of the most frequently used techniques to lower a high-income earners tax liability. In most cases here youre. Web The additional income from your RMDs can push you into a higher tax.

Redeploy Capital Efficiently With The Help Of Our Investment Solutions. Web Surface Studio vs iMac Which Should You Pick. For a limited time only pay 0 in advisory fees for 6 months.

Web Lets review five of the most highly effective retirement tax strategies for. Ad Explore High-Yield Income Investments To Help Investors Pursue Their Unique Goals. Among tax strategies for high-income earners this is one.

We will begin by.

Tax Saving Strategies For High Income Earners Smartasset

10 Tax Planning Strategies For High Income Earners Gamburgcpa

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

Tax Strategies For High Income Earners First Financial Consulting

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Tax Reduction Strategies For High Income Earners Pure Financial

5 Outstanding Tax Strategies For High Income Earners Debt Free Dr Dentaltown

Tax Strategies For High Income Earners Wiser Wealth Management

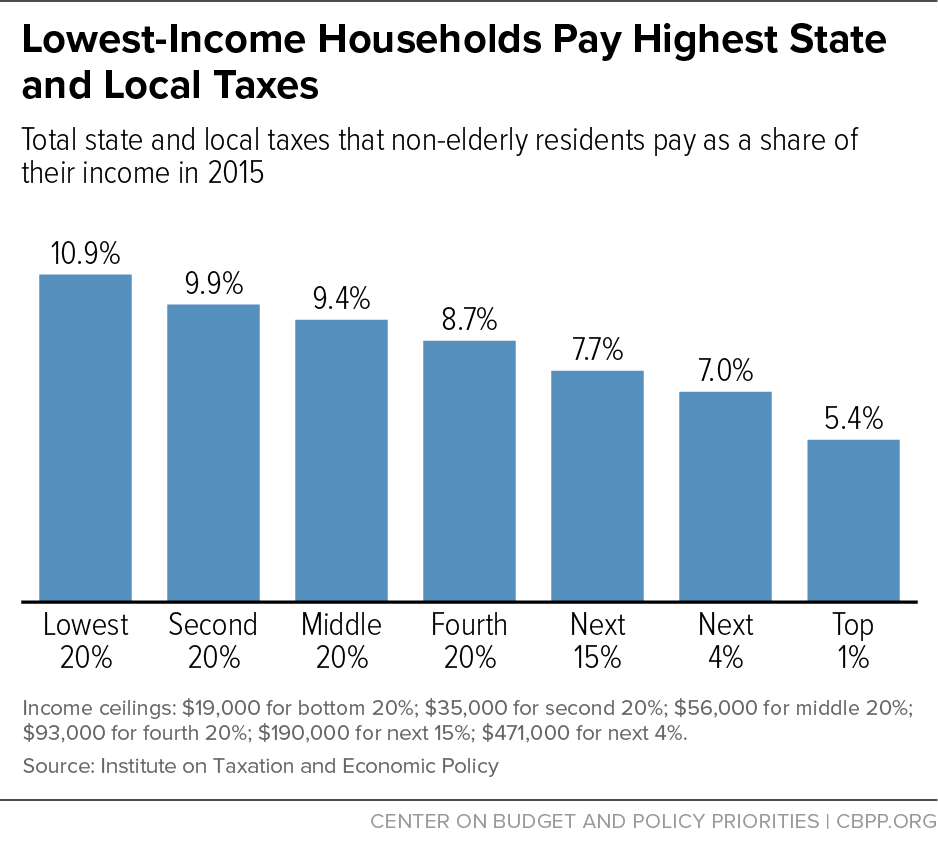

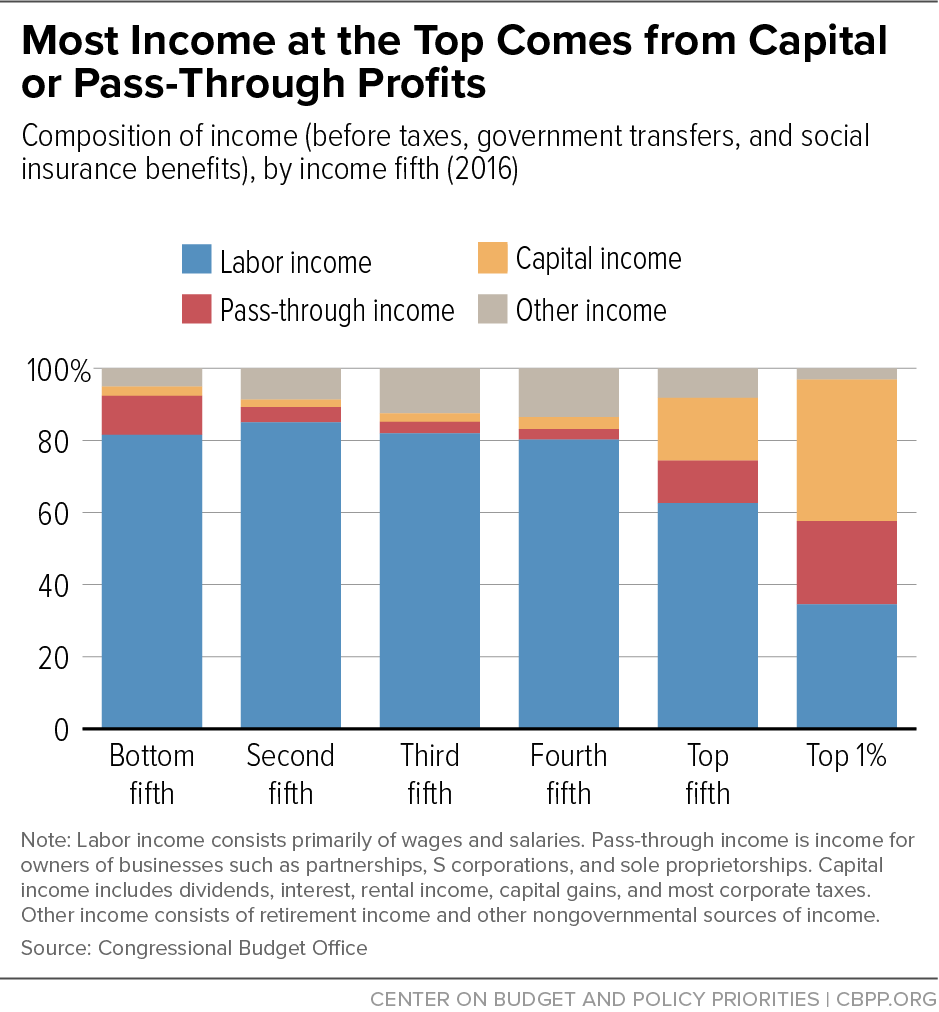

How State Tax Policies Can Stop Increasing Inequality And Start Reducing It Center On Budget And Policy Priorities

Tax Efficient Investing Edward Jones

The Health Savings Accounts Hsa Basics For High Income Earners

The Hierarchy Of Tax Preferenced Savings Vehicles

5 Effective Ways High Income Earners Can Invest Their Income Signature Bank Of Georgia

How Can A High Earner Reduce Current Income Taxes Through A Non Qualified Deferred Compensation Plan

Tax Implications Of Your Financial Planning Strategy Johnson Financial Group

Tax Strategies For High Income Earners Lalea Black

Tax Strategies For High Income Earners Youtube

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities